REITs are firms that focus on managing or acquiring income-generating properties across the property types. These sectors can range from offices, apartments, shopping centres and malls, hotels, warehouse and commercial forests among others. The attractiveness of the REITs is in social interactions that make it possible for small investors to invest in large properties without having to actually purchase each property on their own.

Here are some key points about REITs:

Income-Producing Properties: While investing in REITs the priority is given to the properties that are rented, as REITs are interested in receiving income. The economists favour compared them with landlords only now on a much larger scale. They require tenants to pay their rent and the company forwards a large part of that money to its shareholders.

Liquidity: For this reason, unlike conventional real estate investments that one may find hard to sell and that call for huge capital, REITs are highly liquid. Majority of the REITs are publicly held entities just like any other company with stocks that can be traded in the stock markets. REIT shares can be bought as well as sold with much ease hence being accepted by almost all traders in the market.

Dividends: REITs are required to distribute at least ninety per cent of the company’s taxable income to investors on a yearly basis in the form of dividends. Therefore, should you participate in a REIT, and then you will be in a position to receive dividend yields.

Diversification: REITs have diversified investment portfolios,while some focus on more area kinds consisting of the small sales retail or healthcare area, other investors might risk varied throughout the marketplace sectors. The above diversification helps in risk dispersal and act as source of stability.

Tax Advantages: REITs have the following characteristics;

Tax advantages for the REITs: For instance, they do not pay corporate income tax in case majority of the income they earn is passed to the shareholders. The shareholders on the other hand are subjected to taxes on the dividends they are paid.

Types of REITs:

REITs are classified according to types:

- Equity REITs: These own and manage income producing properties on their own.

- Mortgage REITs: They buy the credits in the form of real estate debt also known as mortgages rather than owning property.

- Hybrid REITs: These are a blend of equity and mortgage.

How Do REITs Work

You should now be able to think of REITs like you do mutual funds of real estate in a given economy. They raise funds from many investors and then invest in buying and running real estate investment assets. Investors benefit in two ways:

- Dividends: REITs make their earnings mainly from rents and/or interest or other income that is derived from real estate holdings. They provide a large part of this income as dividend to the shareholders.

- Share Value Appreciation: It also benefits investors if the price for the REIT’s shares rises with time. Although, the ratio of capital appreciation is normally not as high as the stable income stream tends to offer.

These are an effective investment in property without physical ownership. If given a choice between an office space or an apartment or a shopping mall, REITs present a diversified and liquid way on investing in properties. As long as you do your homework and select the right REITs that subscribe to your investment objectives as well as your tolerance to risk, you’d be on the right track.

What are the potential dangers of investing in REITs?

REIT Investments can be very profitable, but as with any form of investment it has its risks. Let’s explore some of the common risks associated with REITs:

Lack of Diversification

Risk: if one is pooling funds only in a single type of REIT or only in several properties, then one is taking a dangerous chance. For instance, if you have only invested in retail REITs, then it is probable that your portfolio will experience low demand if the market situation deteriorates in the retail space.

Mitigation: Invest in more than one form of REITs for instance office, residential and health-care and or investment in more than one region to reduce risk significantly.

Interest Rate Risk

Risk: It is also established that fluctuation in interest rate has effect on REIT’s performance. For instance, REITs’ profitability is sensitive to factors such as an increase in the interest rate since a rise in interest rate enhances the cost of borrowing.

Mitigation: Interest rate: pay attention to the fluctuating interest rates and how they may impact your invested REITS. Interest rate risks exist within REITs although some are highly sensitive to changes in interest rates than others.

Economic Downturns

Risk: It is to be understood that during the recession periods and during down turn in economy, the property demand is not as high as required. Worse, vacancy rates may go up which in one way or another will impact on rent collections and property values.

Mitigation: Invest smart in REITS with sound financial statements, diverse property holdings and low risk gearing. Although new and high-quality properties are more vulnerable to economic cycles, they stand the test of cycles better in the long-run.

Management Quality

Risk: Some of the issues indicate that management decisions may cause negative effects on the performance of a REIT. Underperformance could be due to inefficient operations, lack of proper maintenance of properties or having wrong resource management strategies in place.

Mitigation: Look at the claim of the management team and the overall idea behind it, competent staff, and its focus on the shareholders’ benefits.

Liquidity Risk

Risk: Non-listed REITs, that is REITs which do not have equity securities in the public stock markets, do not have liquidity. This also may cause problems in the area of liquidity as the shareholders may find it extremely difficult to sell their shares when they want to.

Mitigation: This is especially true if liquidity is a factor in which you have a preference for publicly listed REIT with daily liquidity option.

Regulatory Changes

Risk: The main risks associated with investing in REIT are Fluctuations in taxes. This is in relation to changes in tax laws affecting REITs, changes in accounting standards as well as changes in rules governing the real estate market.

Mitigation: Keep abreast with any regulatory change and its implications to REITs.

Market Volatility

Risk: it can be appreciated that REIT prices may exhibit wide fluctuations in their price throughout time, including during cyclical downturns. As with external variables (e. g., geopolitical occurrences or an unforeseen change in economic conditions), sentiment may change as well.

Mitigation: Learn how much risk you’re comfortable with and remember that REITs could be used in a diversified investment portfolio.

"REITs in India"

These investment tools are considered as an intermediate between real estate and stock that create efficiency for investors to invest in property.

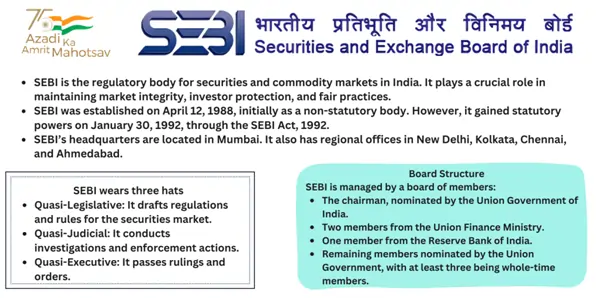

REITs could further be described as an active investment vehicle through which people can get involved in real estate investment and business without directly taking part in owning a property. Thus, the investors can only invest in firms which operate real estate operations or invest in REITs having properties that generate income.

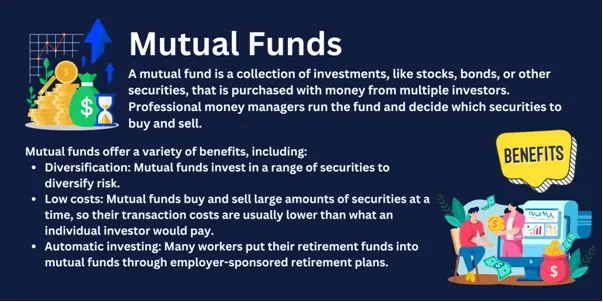

The structures of the REITs arrived in India in the year 2007 by the Securities and Exchange Board of India while the operational structures of REITs were by the year 2014.

How it Work

REITs are entities whereby numerous investors deposit money to be invested and employed to buy, own and eventually manage income generating properties.Often such assets are commercial – office, shopping and commercial storage spaces.It follows that REITs derive their revenue from rent and other ancillary services in relation with their properties. They pay out a greater part of this income in the form of dividend to the shareholders.

Advantages of Investing in REITs

- Diversification: This means that through investing in REITs, one is able to have a diversified portfolio of the real estate assets thus minimizing the risk.

- Liquidity: It differs from direct property ownership in the sense that REITs are publicly traded securities hence are liquid.

- Passive Income: REITs are known to pay their investors good amounts of dividends and they are an excellent source of steady revenue.

- Tax Benefits:it is able to avoid corporate income tax if it distributes majority of its income to investors as dividends.

Disadvantages and Risks

- Market Volatility: In fact, the prices of REITs can be affected by conditional fluctuations from outside factors for example.

- Interest Rate Sensitivity: change in interest rates affects REITs.

- Management Quality: Management’s decisions that are unbeneficial can impact the returns of a REIT.

- Sector-Specific Risks: This means that the REITs are eligible to suffer certain risks associated to certain property segments (for instance, retail segment, office segment).

Types of REITs in India

Currently, India has three listed REITs

- Embassy Business Park REIT

- Mindspace Business Parks REIT

- Brookfield India REIT

These REITs mainly focuses on commercial property or business space, office space and corporate buildings.

Who caninvest in REITs?

It’s easy to invest in REITs for retail investors, institutional investors and even HUF’s (Hindu Undivided Families).Investors can invest through the stock markets through trading of the REIT units.

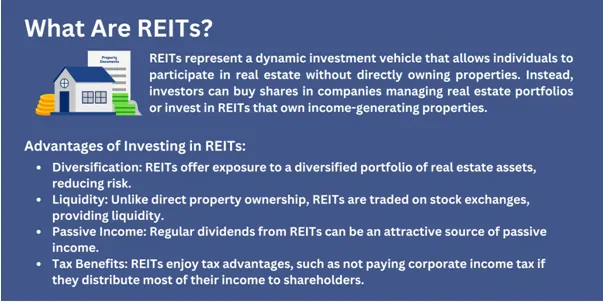

Mutual Funds

Mutual fund is very much similar to where many people contribute to their resources with the aim of getting a unified return on investment. Here’s how it works:

Pooling Capital:Picture a large picnic blanket, where everyone contributes some money towards the investment (or some ‘token’), therefore all this pooled money is called the mutual fund.

Collective Ownership: When you purchase a share in mutual fund you are just buying a piece of the entire receptacle of picnic spread. You actually own a fraction of all the securities in the fund which offers stocks, bonds or any other security.

Professional Management: For simplicity, I shall term the mutual fund manager as the ‘picnic organizer’ who has the responsibility of managing the portfolio. They get to work out how the money should be split between the various sectors and the industries and the companies within them.

Diversification: Have you ever taken a buffet? Mutual funds are similar – except that they offer a range of dishes instead of food. Risk is managed by placing your money in different types of assets; thus, diversification is achieved.

Returns and Risks: Depending on what is being funded, then if the asset value increases, then the share price also goes up. Unfortunately, the value of the assets also goes down.

SEBI: regulation, supervision and policy formulation related to mutual funds is done By SEBI.