The European Union’s Carbon Border Adjustment mechanism is scheduled to commence from 2026. According to this mechanism, the EU plans to levy a financial charge on goods that generate high carbon emissions when imported into the block from countries such as iron, steel, aluminium, cement among others. While the EU says that the CBAM is needed to prevent carbon leakage and unfair competition, countries like India see potential for the policy to harm their economy.

India is one of the large exporters of carbon-intensive products and has not been in support for CBAM in global platforms such as COP29. The country states that through implementation of CBAM, developing countries and least developed nations in particular are locked into technology and cost bearing for climate change mitigation. To counter this mechanism, India can adopt several strategies:

- Enhancing Bilateral and Multilateral Relations: India could use more efforts in improving the existing relations in the field of trade between India and the EU and with others. To this end, India can reduce the effect of CBAM on its exports, through applying for better terms or exemptions. It should always lobby to be exceptions for its highly emitting products and avoid making carbon pricing to be a disadvantage in its trade.

- Strengthening Nationally Implemented Policies: India can improve its domestic climate policies to address concerns raised by the EU by coming up with even more demanding emission reduction solutions and encouraging another sustainable methods and India could prove it is ready to become the part of the climate change solution. This will assist in either getting more favourable conditions under CBAM or lowering the relative carbon intensity of its exports.

- Cleaning technologies: Technological improvements and energy efficiency enhancements can be helpful for India to decrease carbon stress of production. India can reduce exported emissions in the following ways; Introduce new technologies and adopt low-carbon technologies. This will not only assist in compliance with CBAM but also further the cause of improving the export advantage for Indian products.

- Utilizing International Cooperation: India can use several strategies in relation to the international cooperation to fight the CBAM. Such collective action may create count pressures against the hegemonic action of single nation Imposing its unilateral trade measures India can therefore use synergy with other countries particularly those in the developing world to counter this form of liberalization. This include; supporting socially just and progressive climate change policies that are not regressive on the developing countries.

- Climate Finance and Technology Transfer: India can propose to receive climate finance and share new technologies with the developed countries. India has adequate access to financial resources and new technologies that enable it to take proper climate actions and give a reduction to its carbon emissions. This will be of aid in responding to the issues raised the EU or opening the market for exports from India.

- Entertaining Diplomatic Relations: India can sit and talk with the EU diplomatically if they have some issues related to CBAM. One of the things which India along with other developing nations can do is to present its case in various international forums and start a constructive discussion about the specifics of the mechanism so that it would less burdensome for developing nations.

Comprehensive Information on Carbon Border Adjustment Mechanism

The Carbon Border Adjustment Mechanism (CBAM) is a new instrument adopted by the European Union to tackle carbon leakage and to maintain neutrality, with regard to carbon prices, for industries active within the EU territory. To address this issue, CBAM was proposed within the EU’s larger European Green Deal framework, to dissuade companies from shifting production to lower-carbon countries to evade climate costs and erode the EU’s climate objectives.

What is CBAM?

The CBAM can be said to be carbon tariff that Europe puts on goods produced by countries that do not have stronger environmental policies compared to the Union’s. In a bid to level the carbon cost between domestically produced goods that are subjected to the EU ETS and imported goods, the EU proposes to place a carbon price on certain imports. This mechanism seeks to promote cleaner production processes around the world, and to avoid the eroding of the EU climate measures.

How CBAM Works

- Scope and Coverage: When implemented, CBAM will first target a set of countries and a narrow basket of goods that contribute to the emission of high levels of carbon dioxide such as cement, iron and steel, aluminium, fertilizers, and electricity.

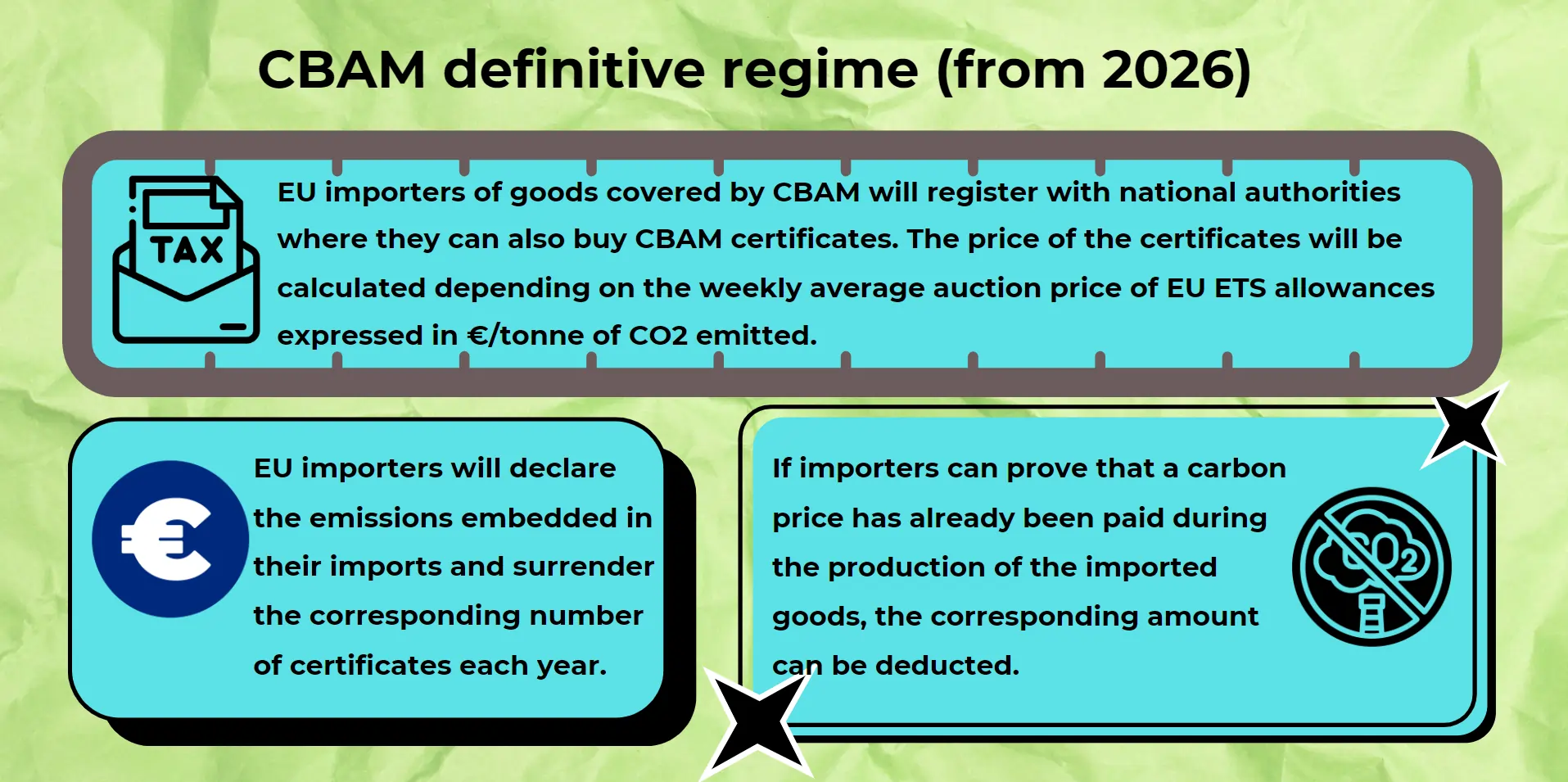

- Carbon Pricing: CBAM certificates equivalent to the emission values of the covered goods will be bought by importers of covered goods. The price of these certificates will be aligned with the rate of EU ETS allowances meaning goods imported into the EU will face a comparable carbon price as the EU domestic products.

- Emission Calculation: The carbon content of imported goods will be estimated from information submitted by importers supplemented by audited information. In case actual emission data are not reported default values will be used which are the highest values possible so that emission levels are not under reported.

- Transition Period: CBAM was been introduced incrementally, in 2023 when importers submitted their emission data but will not yet be required to purchase CBAM permits. The complete roll out is set to happen in 2026, ensuring that compliance plans can also be put into place before it is fully enforced.

- Revenue Use: CBAM revenues will be paid into the EU budget and can also be spent on climate projects in EU and developing countries. This corresponds with the EU intended plan on provision of support in implementation of climate mitigation and adaptation processes globally.

The European Union’s Carbon Border Adjustment Mechanism (CBAM) is a newly developed policy impacting on carbon leakage and providing climate action shifts globally. CBAM wants to make companies around the world act responsibly towards the climate to stop giving unfair competition to European industries By attaching a carbon price to imported goods that do not meet the Revised EU ETS standards, the EU aims to level the playing field for European industries and make the rest of the world play by the rules of climate change.

Pros of CBAM

- Level Playing Field: CBAM has the potential to be one of the greatest advantages because it contributes to the creation of a competitive environment for industries in Europe which are facing strict limitations on emissions. CBAM works by putting a carbon cost on imports, so that foreign competitors have the same costs, and thus cannot compete with European industries choosing cleaner options.

- Reduction of Carbon Leakage: That is why CBAM was designed to tackle carbon leakage, which means when companies move their production to countries with lower climate policies in order to avoid costs associated with carbon. CBAM is able to prevent such shifts and keep production within the EU by applying a carbon tariff to imported goods.

- Incentive for Global Climate Action: CBAM puts a carbon price on import products motivating countries in the external block of the EU to rope in stringent policies on emissions. This may ultimately result into a decrease in greenhouse gases emissions globally since more countries will be trying to conform to the EU carbon outcomes to retain market access.

- Promotion of Cleaner Production Practices: CBAM supports industries around the globe to reduce greenhouse gas emissions by using cleaner production methods and implementing efficiency technologies. It can foster development of sustainable technologies and be supportive in global practices for fighting climate change.

- Revenue Generation for Climate Projects: Such revenues can hence be used to support climate action projects within the EU as well as within the developing countries. This is in accordance with the EU objective of helping other countries reduce and adapt to climate impacts.

Cons of CBAM

- Potential Trade Conflicts: CBAM may result in trade conflict or disputes because it shall be perceived as a protectionist policy by other countries. Due to strained relations between the Europe and the countries CBAM will instigate retaliation by the EU that may proceed to the WTO and complain that this contravenes international trade laws. It may well result in trade disputes and tensions and subsequent countermeasures damaging trade relations.

- Implementation Complexity: The success of CBAM depends on the correct computation of carbon content of imports and validation of emission information. Monitoring, reporting, and verification are generally costly and establishing complicated procedures are not easy. Compliance and fraudulent activities will be another important item that needs to be reckoning with, if this mechanism needs to work.

- Impact on Developing Countries: Holding that developing countries do not have the fiscal capacity to invest heavily in low carbon technologies, CBAM may have a more pronounced impact on such economies. It may pose some difficulties for these countries to access the EU market, which might results in a negatively influencing their development. There is a need for the EU to analyze ways that would support the nominee countries to move towards a green approach to production.

- Administrative Burden on Importers: The problem with CBAM is that it creates an administrative compliance cost for importers who need to determine and declare the carbon content of the products they bring into their countries. This always leads to raised compliance costs and, in some cases, genesis of more paperwork; issues that may reach small and medium sized businesses because they could not afford to get an understanding of these regulations.

- Risk of Price Increases: Pricing implications associated with the additional carbon costs as implemented through CBAM would be the increased costs of importation of products. This would mean that price of consumer goods within the EU may be affected and bring inflation among the consumers.

Consequences of Carbon Border Adjustment Mechanism (CBAM) to India and Other Developing Nation

EU’s Carbon Border Adjustment Mechanism (CBAM) an attempt to shift its high-carbon industries overseas and exert pressure on other countries to act on climate change by putting a carbon tariff on imported goods with a high carbon content. They in turn are facing several issues in the form of challenges due to this mechanism aimed towards sustainability, for India and other developing nations.

Economic Impact on Exports

It has numerous drawbacks, and is likely to affect the export levels of developing countries. Currently, countries such as India, China and Brazil sell large amounts of steel, aluminium, cement and other carbon- embedded products to the EU. This may result to high costs that make Indian goods uncompetitive with the ones from other countries. As a consequence there would be lesser export income and cut affect the companies which gross more than seventy five percentage of income through exporting to the EU.

Compliance and Administrative Burden

CBAM insists that importers estimate and declare the carbon content of their goods. This is a big problem for developing nations, hard administrative work. Small and medium enterprises (SMEs) are well known to have constrained capacities in the technical aspects of computing and reporting their carbon footprint. These aspects might pose some operational challenges and even bring high costs for compliance in the countries.

Expenditure on clean technologies

As we have seen, CBAM is meant to incentivize cleaner technologies, but developing nations may be unable to make these investments. The global shift to low carbon intensity production sometimes needs huge capital which an emerging country may lack. Many developing countries face challenges in accessing cheap financing and technologies to meet CBAM rules and decrease emission.

Effects to the Economic Development

Newly industrialised nations still depend on industries that emit large amounts greenhouse gases for employment and growth. The introduction of CBAM could upset these industries, meaning possible departure of job opportunities and upset in the economies. In European countries, there is likely to be little impact of CBAM, however, for the countries such as India, who rely on millions of people working in sectors such as steel and cement, the effects could be far-reaching economically and socially.

Trade Relations and Diplomacy

The CBAM scheme may put significant pressure on the relations between the EU and the developing countries. Some of its critics such as India claim that the mechanism looks like protectionism, a vice against the principles of free trade. This could certainly push to trade tensions and protective measures over international trade resulting to conflicts.