In her speech, Minister of Finance Smt. Nirmala Sitharaman introduced the budget of Union for financial year 2025-26 which originates the government’s funds and its manage and plans for the next financial year. A new taxation system is being introduced that gives the middle-income tax relief scheme that allow income tax exemption for the people those whose annual income is up to ₹12.75 lakh. From the tax reform, the growth rate of the economy is expected to improve because it fosters higher saving and consumption at the consumption level. This is because, capital expenditure has been at ₹10 lakh crore which is a 33% enhanced from the previous financial year towards infrastructure development. The above capital allocation will lead to an increase of development in all the big sectors within the economy besides achieving India’s extended development objectives. The farmers would easily obtain funds as the government intends to set up the agriculture targets of credit with ₹20 lakh crore in the agricultural sector.

The green energy received a funding of ₹ 35,000 crore through the budget for clean energy transition to meet India’s ever-growing pace to harness more renewable power resources. The credit guarantee scheme of the government regarding MSMEs has enhanced the access to credit with the additional amount of ₹9000 crore for increasing the innovation as well as the entrepreneurial initiatives related to the Micro Small and Medium Enterprise sector. Through the establishment of 157 new colleges of nursing, healthcare sector addresses the existing trained nursing staff shortage. Conveyance from UIDF fund supports the construction of 10,000 crore rupees yearly for the development of urban structure in order to refine the lifestyle of city people.

MASSIVE INCOME TAX CUTS

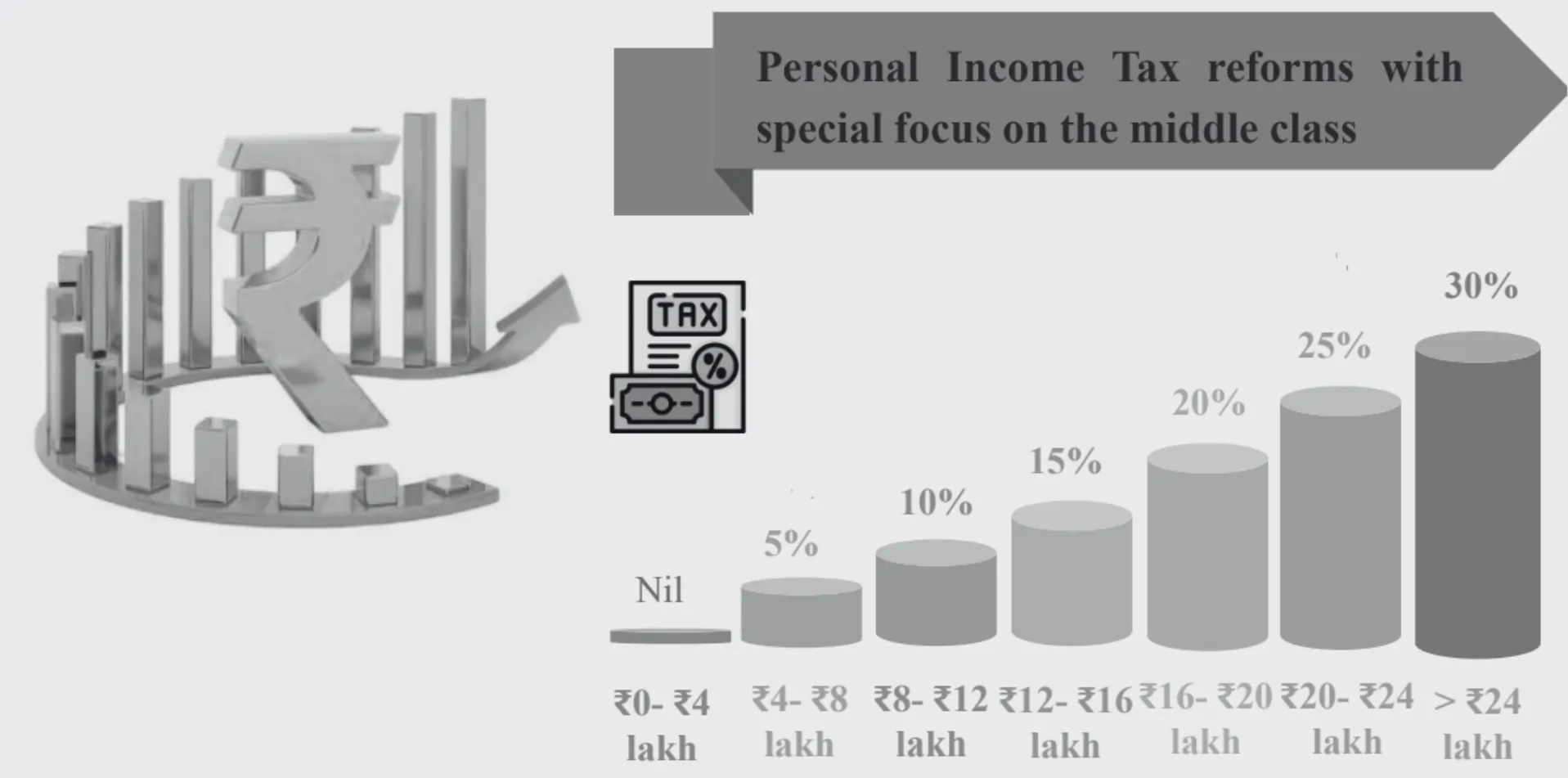

In the session of Union budget 2025-26, the Finance Minister announced several income tax cuts for the purpose of raising as many tax-assisted funds as possible. These tax cuts will be reciprocated by huge growth in the economic growth alongside growth in household savings and expenditure.

According to the new tax system, every citizen is free from income tax if he/she earns up to ₹ 12 lakh annually. This is way far much higher the previous condition of ₹7.5 lakh. The changes in the tax slabs have been made in a way to help expand the middle class as the funds collected from this class are used to fund some of the most essential needs in the country, so enhancing their purchasing power stimulates the domestic economy.

The Finance Minister pointed out that it is this tax exemption that is aimed at the middle class, which has always been the main engine of the Indian economy. In cutting the tax rates the government aim at increasing sheds holdings on consumer goods and this would include the fast moving consumer goods and prices (FMCG’s) consumer electronics and small passenger vehicles. This should lead to the development of production capacities and thus job opportunities in the country.

Most of the industry stakeholders have applauded the tax cut measures with the hope that the downturn which has been realized in the market due to the financial difficulties will be reversed. Even the International Monetary Fund (IMF) has estimated that the income tax reduction would stimulate the consumption level by as much as 10%, the implied economic growth being around 8%.

FISCAL DEFICIT

This is actually the reduction in fiscal deficit that is rather important for a long-term progress of financial stability. Achieving this, the government has increased its revenue and expenditure by find ways on how to balance the two. While the income tax cuts provide significant opportunities for lost revenue, the government has made up for this by better collection of GST and compliance measures.

The budget also provides for sustainable development by providing the required fund towards important sectors including infrastructure, agriculture, and health. The capital expenditure has been raised to ₹11.21 trillion which constitutes a large amount for the construction projects. This investment is anticipated to stimulate economic activities in the country and hence generate employment.

Also, the government has implemented programmes to develop agriculture which include launching of a national mission on production of high yielding varieties and credit planning for farmers. These are targeted at promoting increased national income and agricultural productivity in rural areas. Specific operationalization of factors in the healthcare industry, which signify the destination-oriented model of human capital development, include new and additional financers for the creation of new nursing colleges and infrastructure improvements, enhanced healthcare services. With regard to the expenditure side, the budget seems to endorse green energy programs as seen from funding towards energy transition projects.

CAPITAL EXPENDITURE

The change in the view of the government expenditure strategy is new focus on capital expenditure or capex. In the prior years, further increases in capex to foster overall GDP growth has invariably been reflected in the successive budgets, but in the latest budget no such acceleration in capital acquisition has been visible wherein, the targeted capex for FY26 has been estimated only at ₹ 11.21 trillion–up by just 10% as compared to the previous year.

This is a change of tact from state-led models of development to promote private sector financing and PPPs to drive infrastructure works. They want to use inducements for manufacture and other sectors to encourage companies to drive the privy sector and thus cut expenditure on capex by the government.

There is however, a continuing strong emphasis on infrastructure with more funds proposed for urban development and rural income and new energy. The Urban Challenge Fund of ₹ 1 lakh crore will facilitate the transformation of cities of India and the calibrated national mission on high production of food grains and improve agricultural credit will help farmers.

The government’s decision to consolidation approach in its fiscal policy with checks on the growth of capital expenditure is a correct policy mix that makes economic liberalisation balanced and sustainable. To increase the level of private investments and achieve a more sustainable and less vulnerable economy, the government budget provides a Favorable environment.

EMPLOYMENT GENERATION

Union Budget 2025-26 presented by N. Sitharaman gives substantial importance to job creation with focus to fund selective sectors having good job genesis. As part of enabling job creation and positively impacting the job market, the budget provides some measures sought to create a Favorable climate for employment in the different sectors.

This is evident by their focus on the National Skill Development Mission that has been allocated ₹15,000 crore. Therefore, this initiative seeks to be a tool to improve the stock of human capital and to address the issue of skills gap in labour market. This is due to the fact that most of the countries boosting sectors that the company focuses on such as information technology, manufacturing and health are expected to experience high growth rates in the future.

The budget also speaks of manufacturing sector requirement via the new Production Linked Incentive (PLI) scheme to new generation manufacturing industries. This forbids companies to gain more percentages the power to offer increment in production, meaning that through this scheme, companies will increase production to create employment. Moreover, ₹10,000 crore has been provided for the establishment of industrial corridors and clusters, which is assumed to attract investment and create new jobs.

In agriculture, one of the goals when preparing the budget is to increase the agriculture credit upto ₹20 lakh crore so as to have easy access of funds for procuring equipments, seeds, etc. Such effect may lead to improvement of yield per acre as well as creation of employment opportunities many of which are likely to be created in the rural area in form of development of industries that complement agriculture for example agricultural value chains.

Healthcare is another area of focus in its education system that is enhancing the social infrastructure through the addition of 157 new nursing colleges in the country. This policy will help in addressing the scarcity of trained human resource in the provision of health care as well as the general enhancement of health standards; it will create ample employment opportunities within the health sector.

The budget also highlights commercialization with an extra ₹9,000 crore for the credit guarantee to MSMEs business sectors. It is out believed that this is likely to help in increase the probability of credit agencies to fund small business helping in creation of more jobs.

All in all, the Union Budget 2025-26 has a remarkable employment friendly approach as it aims to create jobs by giving facilities to the skill development sector, manufacturing sector, agriculture, health care and small businesses. These steps are expected to ensure that the labour pole is much more vibrant and open which is very essential for the growth of the economy of the country.

REGULATORY REFORMS

Most of the changes in regulatory reforms are aimed at simplification of the bureaucratic procedures involved in the conducting of business as well as creation of a favourable environment for business.

The highlight of the measures proposed in the regulatory reforms entails the easing of compliance burden for companies especially the Micro, Small, and Medium Enterprises (SMEs). The government where it reduces the number of filings and paperwork it requires to be filled will relieve the burden of diligent paperwork to aid the business especially small businesses to expand and innovate. It has been a positive move to propose a single-window clearance for all types of approvals related to business and projects.

Moreover, this budget envisages the creation of the post of the Regulatory Reform Task Force, the main objective of which will be to search for scrutinize existing regulations and propose those that are unnecessary and counterproductive for removal. This will be a special task force which will have to periodically check the effectiveness of the regulations and consult the industry members in order to bring the regulations of the stock exchange up to date with the current economic situation.

The budget also presents policy measures that will strengthen the processes aimed at increasing transparency and accountability of the regulatory system. The establishment of sound digital governance will help the government to monitor and report cases of regulatory compliance in real-time thus discouraging corruption and delayed bureaucratic procedures. This is because this move will help to bring about improved confidence among investors, whether the investors are national or international investors.

Another area of the many changes that have been emphasized is the consumer protection and competition law. According to the current budget, the Indian government plans to create the Consumer Protection Authority in India with authority to tackle consumer complaints and implement laws on consumer protection efficiently. This step opens the way to making the market fair and balanced, to the advantage of both the consumers and the businesses.

The clamour for demanding regulatory reforms in the Union Budget of 2025-26 has come in the right earnest but is quite late in being formed in a bid to enable free from red-tapeism, a transparent, and a business-friendly environment. They include facilitation of foreign investment, improvement of the investment climate, and, above all, enhancement of economic growth through FDI.

Altogether, the reviewed rules for the financial year 2025-26 Union Budget represent continuity of consistent efforts made by the government to develop a stronger and liberalised economy for the enterprises and customers alike.