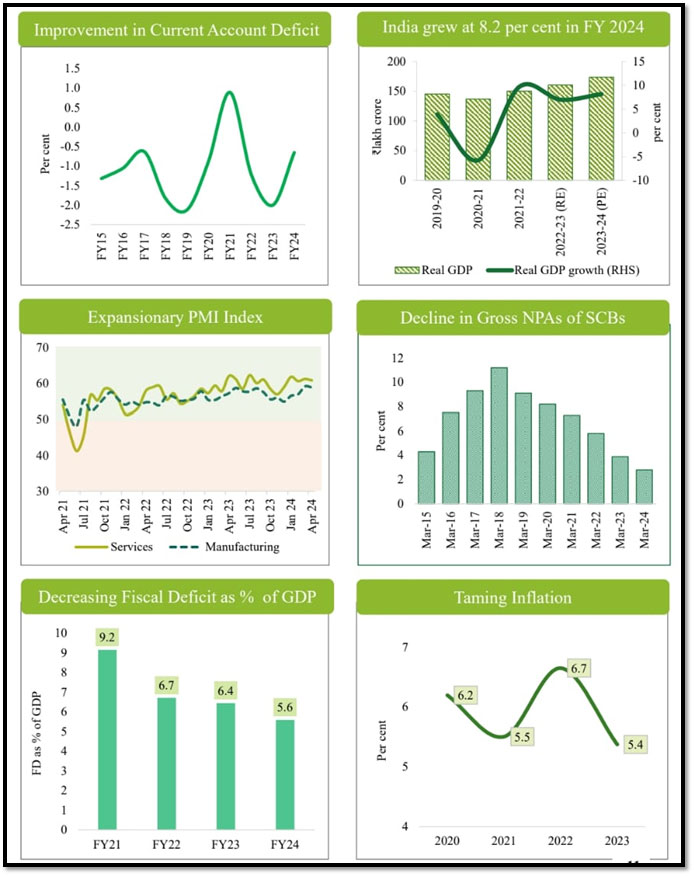

Global economy has not changed its policy ambiguity and this aspect will go on being unchanged in the following years, but it has

one glorious exception and that is India. Speaking in the Parliament while outlining the Union budget 2024-25, the Minister of

Finance and Corporate Affairs Smt Nirmala Sitharaman informed that inflation in India is still low, steady and is nearly touching

the targeted 4 percent. Core inflation or inflation of goods and services other than food and fuel is at 3.1 percent and there

are efforts to ensure that the quantities of perishable commodities in market are restocked adequately.

Download Union Budget 2024 Features PDF

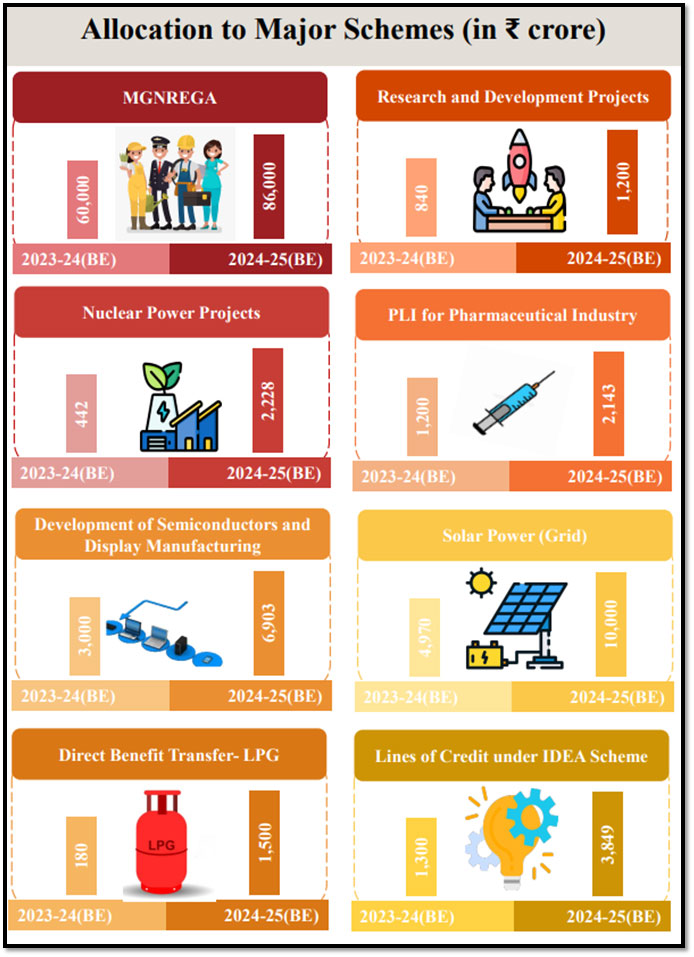

Expenditure of Major Items

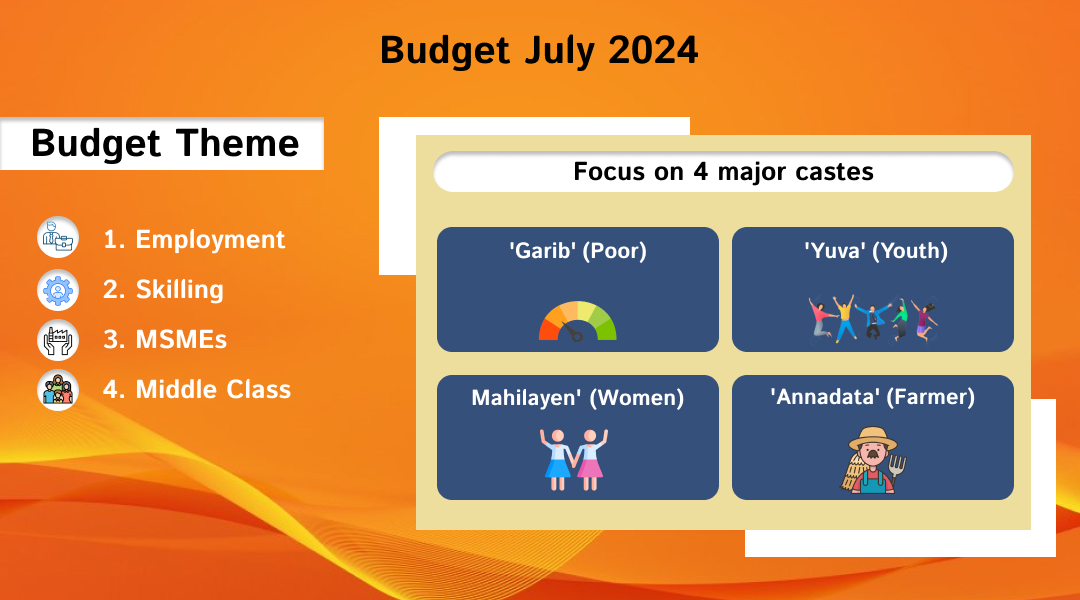

Budget Theme

Looking towards the demand of the time government has come up with the 4 major themes to bring the change and development in

the country. Union minister on finance has mentioned these themes as well as 4 major castes as the priority area of the

Government.

Budget Priorities

Finance Minister categorically declared that for generating employment in ‘Viksit Bharat’, the budget aims constant work on the following nine areas for sufficient job opportunities.

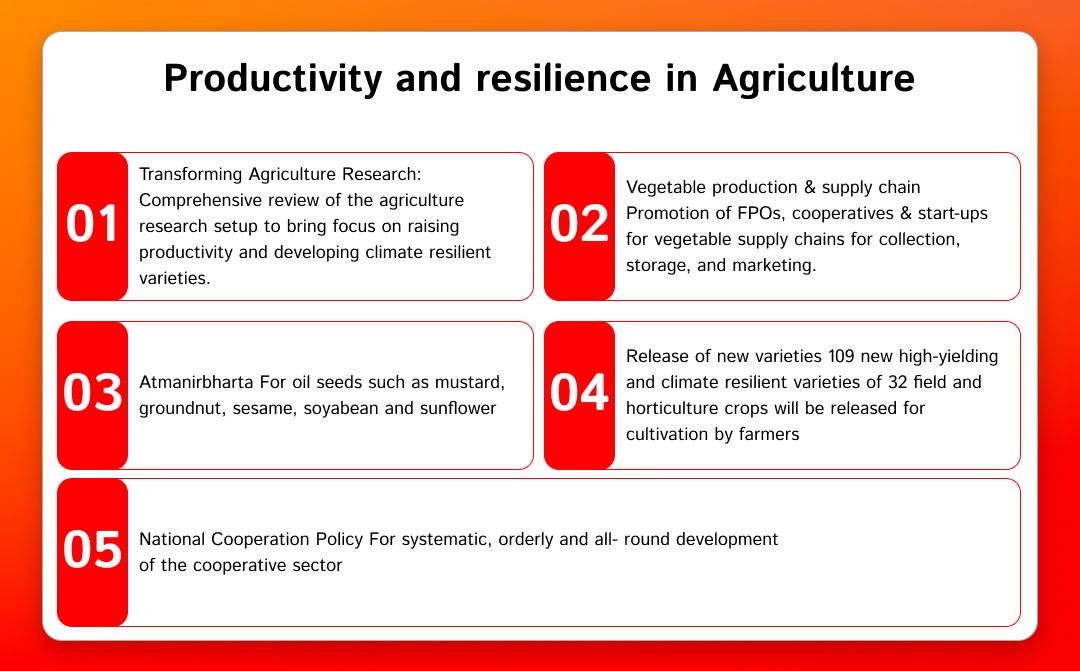

Productivity and resilience in Agriculture

- Currently the Finance Minister has indicated that there is going to be an enhancement of agriculture research so as to increase flow.

- There will be introduction of new HYV and climate resilient crops, 1 crore farmers will be trained in natural farming.

- 10,000 bio-input resource centres will be opened; the government will also enhance the production, preservation, and sale of pulses and oilseeds.

- For the Agriculture and allied sectors sum of ₹1.52 lakh Crore has been announced by the Finance Minister.

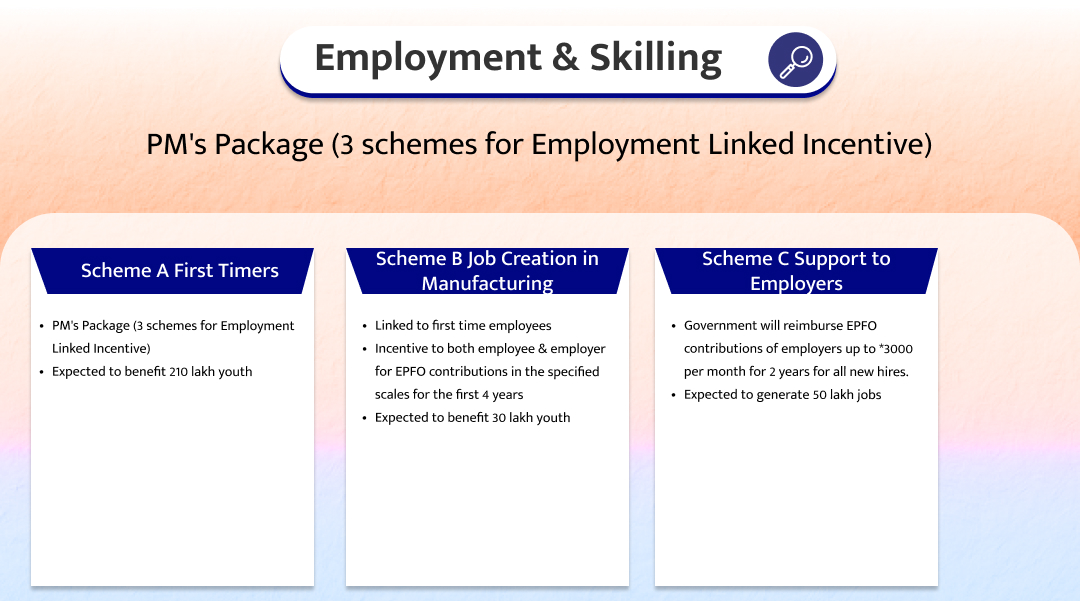

Employment & Skilling

- The Indian government aims to advance three Employment Linked Incentive programs.

- Focus is on the first-time employee recognition, and employer support.

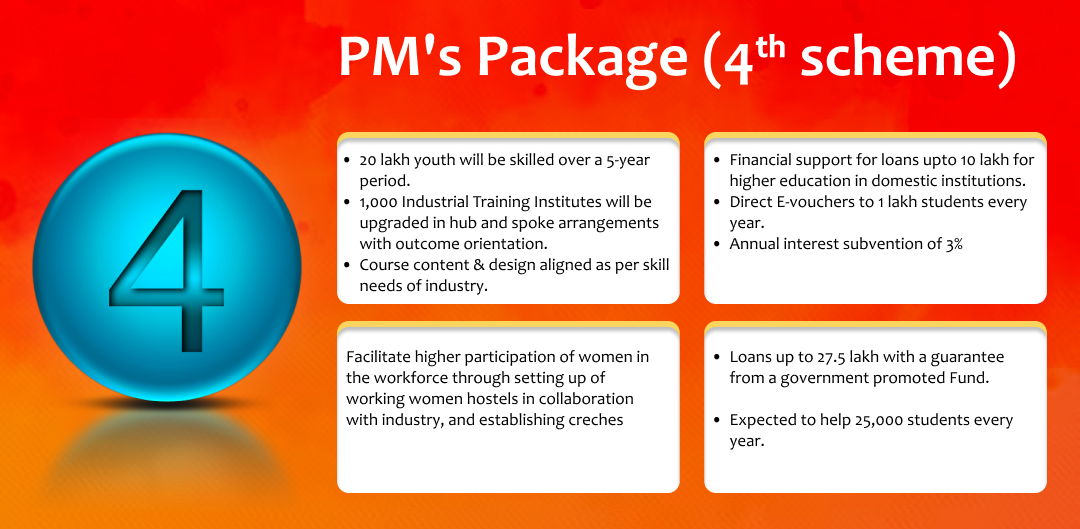

- Working women hostels and creches another measure that the government will use to enhance employment for women and enhance women’s workforce participation.

- Another central government scheme for skill development in convergence with state governments and industries will facilitate skills to 20 lakh youths over a period of five years.

- The scheme of Model Skill Loan will be modified so as to enable skill loans of up to ₹7. 5 lakh.

Inclusive Human Resource Development and Social Justice

- Finance Minister has laid emphasis on the Inclusive human resource development and social justice & had far-reaching schemes in economic activities of craftsmen, artisans, self-help groups, SC/ST & women entrepreneurs & street vendors.

- According to government provisions there is intention to draw up and implement the Eastern Regions plan, called Purvodaya, in the areas of Human Resources Development, Infrastructure and Economy.

- Also, Government is to start the Pradhan Mantri Janjatiya Unnat Gram Abhiyan and it is estimated that it will benefit 5 crore tribal people.

- Above 100 Post Payments Banks to be established in NE region.

Manufacturing & Services

- MSMEs, manufacturing and exports have been given special importance by the Indian government and to finance it there is a self-funded guarantee fund which can go up to ₹ 100 crore of each applicant.

- Public Sector Banks will develop its internal capacity for credit evaluation of MSMEs and a new channel for providing MSMEs bank credit in to be set up.

- Mudra loans will be increased to an amount of ₹20 lakhs for those who had the earlier Mudra loans repaid fully.

- The government will undertake a mega campaign for internship placement linking with 500 leading organizations for 1 crore youth in 5 years.

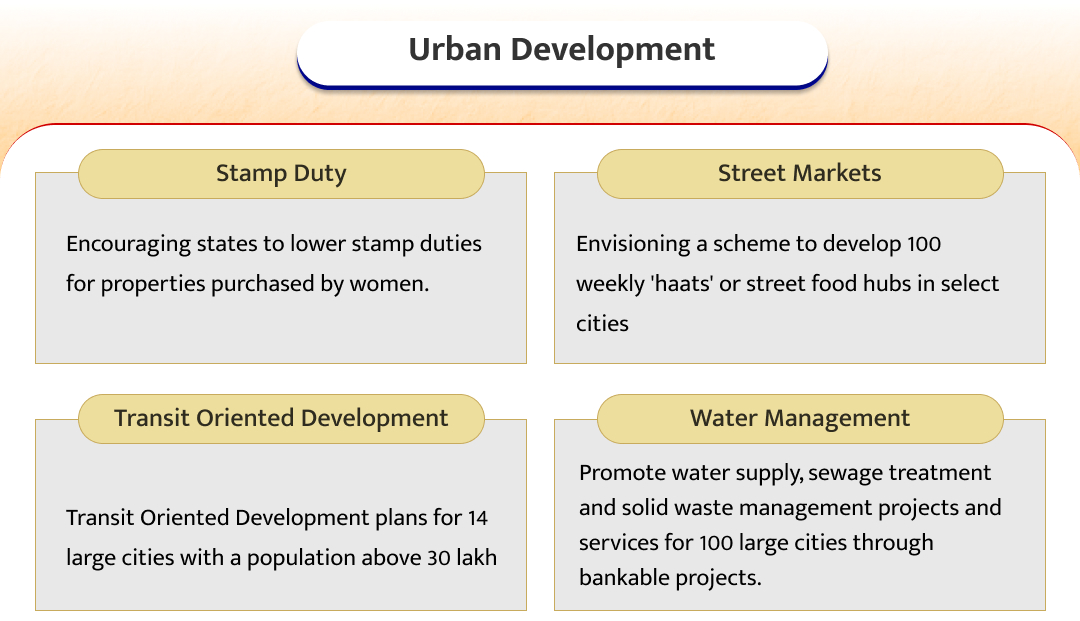

Urban Development

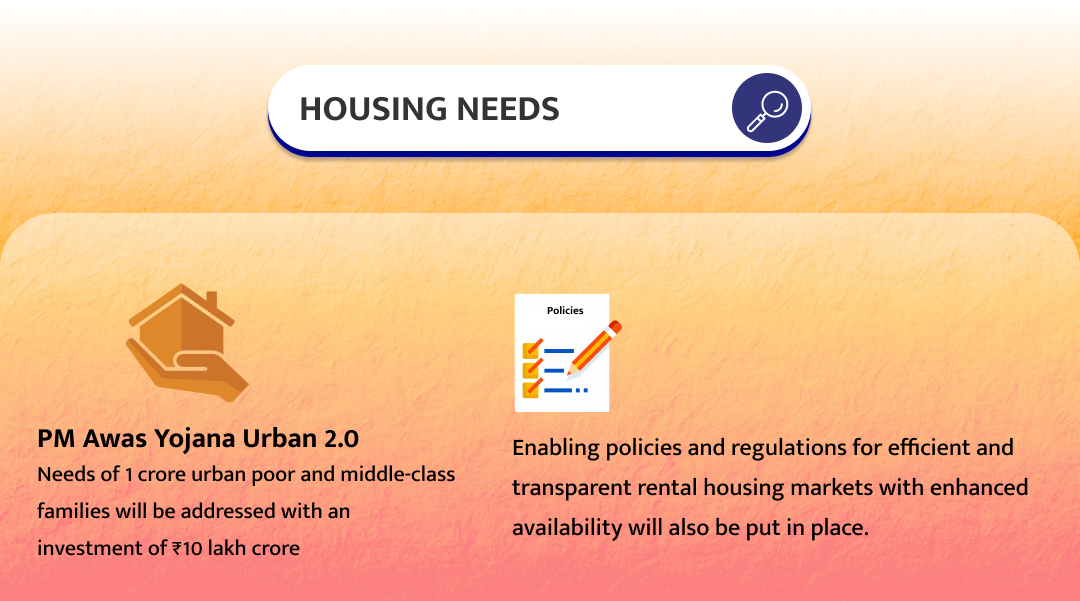

- Under the PM AwasYojana Urban 2.0 government has planned for constructing houses for urban poor through public and private partnership.

- With help of the institutions like multilateral banks and the State governments the Indian Union Government will prioritize the water supply and sanitation.

- Government will work for the street vendors in the urban work space.

- Developmental plans for the select cities.

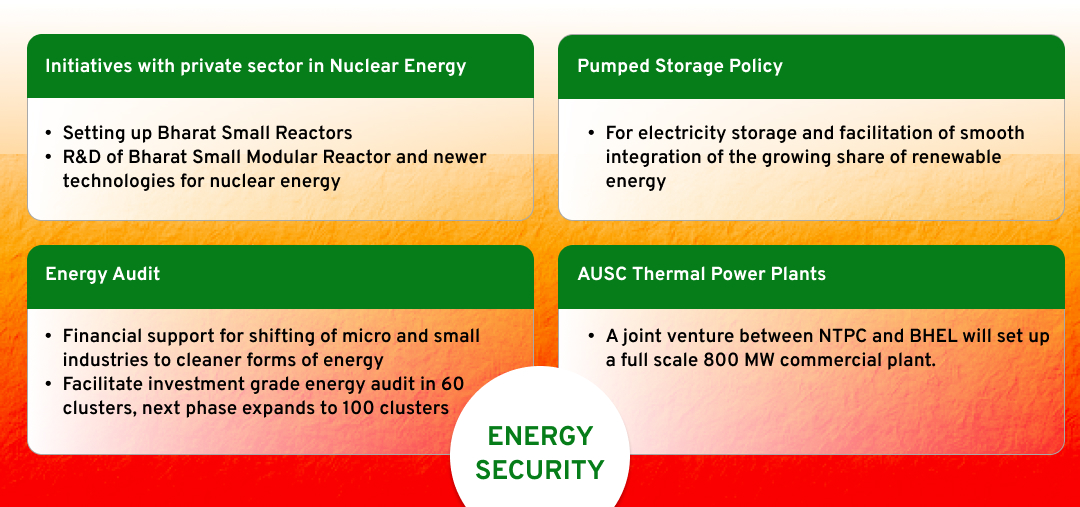

Energy security

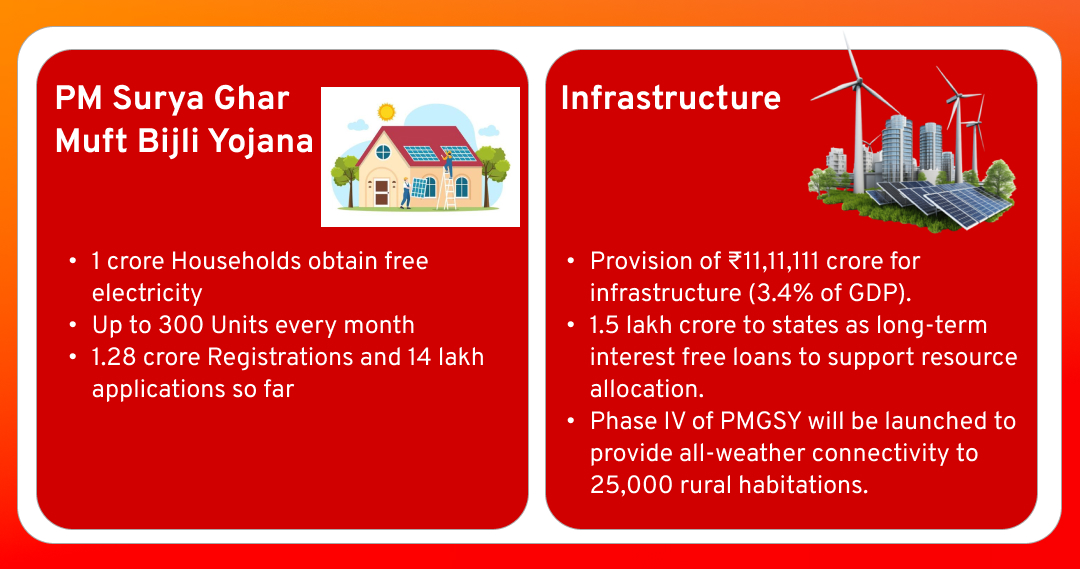

- The Finance Minister said that conforming to the announcement made in the interim budget, there is the PM Surya Ghar Muft Bijli Yojana to provide for rooftop solar plants, enabling 1 crore homes to get free power up to 300 units per month.

- This project has responded very well and government has registered more than one crore 28 lakh registrations and near about fourteen lakh applications.

- The nuclear energy has a considerable part in the vision Viksit Bharat energy structure.

Infrastructure

- It considers Infrastructure sectors as a priority, intent on sustaining the fiscal support for the next five years, by the Central Government.

- It was noted that target for capital expenditure has set to 4 per cent of GDP.

- PMGSY IV will ensure road connectivity of 25,000 rural habitations using the strategy ‘connecting the unconnected’.

- Govt. will also flood management and finance irrigation in States like H.P (Himachal Pradesh), Assam, Bihar, Sikkim and Uttarakhand.

Innovation, Research & Development

- The Finance Minister in her speech mentioned about the Up-gradation of the Anusandhan National Research Fund for basic research and prototype development

- For this ₹1 lakh crore will be driven from private sector through financing pool.

- ₹1,000 crore venture capital fund to be set up for expanding space economy.

Next Generation reforms

- The government of India is intending to prepare the Economic Policy Framework for the successive generations of reforms with the special reference to employment prospects and growth sustainability.

- For climate financing a taxonomy be developed.

- Simple rules to be incorporated to promote FDI inflow.

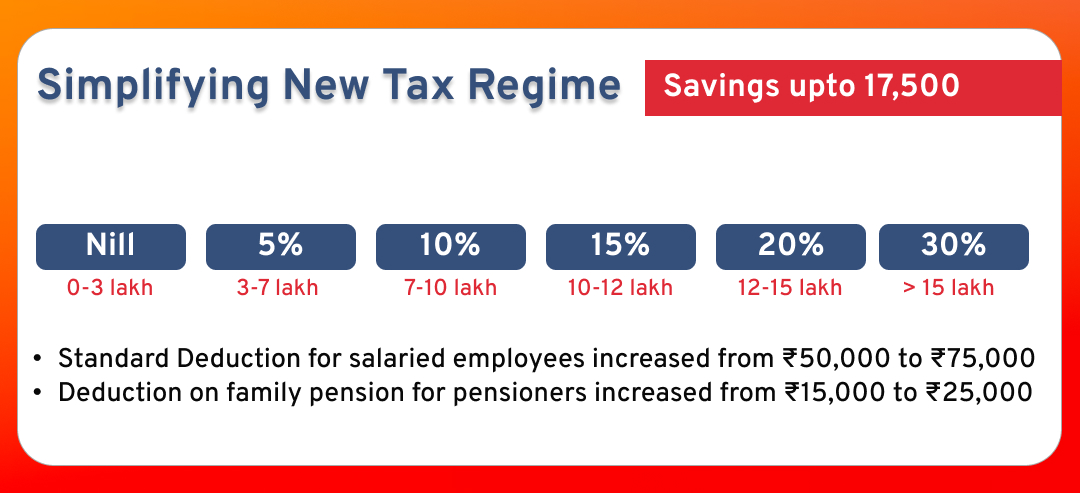

Taxation

- According to the Union Budget 2024-25, there is an intention to rationalize direct and indirect taxes, bring down tax ratios and charges & lighten the taxes burden & expand tax circles.

Direct Tax Proposals

To reduce the compliance burden, promote entrepreneurial spirit and provide tax relief to citizens

Rationalisation of capital gains

- Short term gains of financial assets to attract 20% tax rate

- Long term gains on all financial an non- financial assets to attract a tax rate of 12.5%

- Increase in limit of exemption of capital gains on financial assets to *1.25 lakh per year

Employment and Investment

- Abolish ANGEL tax for all classes of investors.

- Simpler tax regime to operate domestic cruise

- Provide for safe harbour rates for foreign mining companies (Selling raw diamonds)

- Corporate tax rate on foreign companies reduced from 40% to 35%

- The current system of taxation will be made more effective, and the rate structure of the Custom Duty will be adjusted for the enhancement of the tax foundation and helping domestic manufacturing industries.

- Standard deduction from salary income shall be raised from ₹ 50,000/- to ₹ 75,000/- for the persons who prefer the new tax slab.

- The tax regime rate structure shall also be change to offer a salaried employee exemption up to ₹ 17,500/- in income tax.

- The budget has empowered the business environment and new business creation; this has done away with the angel tax for all classes of investors.

- In manner to encourage foreign shipping companies which carry out domestic cruises the tax regime will be rationalized and the corporate tax rate for foreign companies will be lowered from 40% to 35%.

- The methods of taxation involving direct taxes to charities, the TDS rate structure, and the capital gains tax will be made much more straightforward.

- The limit of exemption of capital gains has been raised to ₹ 1.25 lakh to facilitate the lower and middle classes.

- New tax slab is as given below:

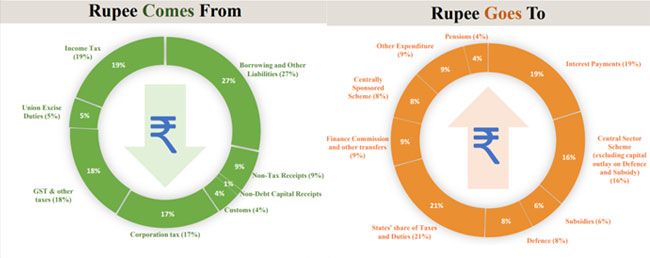

Budget has two components as from where money has come to the government and where the government will spend the money.

Performance of Indian economy