UPS: Unified Pension Scheme

The Indian government has recently resumed the provision of assured pensions to its employees, while pension arrangements have become a problem throughout the world. According to the Reserve Bank of India the total budgeted amount for pension for the year 2023-24 was ₹5,22,105.4 crore which is amount of 6%-21% of total receipts of the state from its revenues. This is an issue that sparks controversy where pensioners argue that wages as well as pension from the exchequer is at the expense of the future generation. Indian Governments are outsourcing simple jobs through many contract-based employments and came up with innovations like ‘Agnipath’ which has detrimental impact on the state capacity and also has diminished the prospects for jobs in government and public sector for the increasing number of youths in India. The Cabinet cleared the Unified Pension Scheme (UPS) would steer the plan to give pension of 50% of average of basic wages of the last one year preceding the retirement and with a floor of ₹ 10,000 for persons who have served at least 10 years.

What is Unified Pension Scheme(UPS) ?

The Unified Pension Scheme(UPS) which still awaits implementation as planned on 01.04.2025 aims at providing a genuine pension to the Indian government employees. For instance, the pension plans to be given to the employees who would have served for 25 years. Pensions for those that retire with shorter service years will be lesser and should not be less than ten years of service. Besides there are other additional benefits as benefit for family as family pension, also it includes inflation and has a provision of minimum pension of Rupees ten thousand.

What is the Unified Pension Scheme?

The Central government approved a new pension scheme on 24th August called the Unified Pension Scheme (UPS). The UPS includes provisions for a fixed pension amount, ensuring retirees receive a guaranteed and predetermined sum regularly after retirement.

When will it be implemented?

The UPS is set to be implemented from April 1, 2025.

How is the pension calculated under UPS?

Under UPS, if you work for 25 years or more, you will receive 50% of your average pay for the preceding 12 months as a pension, adjusted for inflation through dearness allowance.

Do you have to contribute more under UPS?

Employee contributions will remain the same under the UPS. However, the government will increase its contribution from 14% to 18.5%.

Benefits of Unified Pension Scheme (UPS)

Unified Pension Scheme (UPS) is a major reform in the context of helping the Indian government employees to have basic financial security during retirement. It has been planned to come into operation from 1st April 2025. The main advantages are as follows:

- Secured Pension:Those qualified to receive pension are those who retired after serving for not less than 25 years of service, their pension will be 50% of their average of the salary of the last one year of their service. Those with relatively short years of experience will be entitled to similar and will be on the basis of ten years of service and above.

- Minimum Pension: To ensure that the employees earning lesser wages get a minimum of ₹10,000 per month after retiring, the scheme is there to cover up this aspect.

- Family Pension: If an employee dies, his or her dependants will receive sixty percent pension.

- Inclusion of Inflation:Inflation will be factored in with reference to pensions, for example, if inflation increases by 10% therefore pension amount adjusts according to it.

- Dearness Relief:it is adjusted according to the CPI-IW (Consumer Price Index for Industrial Workers).

- Lump Sum pay-out: Employees are to be given a lump sum payment upon their retirement which amount shall be determined at one-tenth of their monthly wage, for every full six months of service.

What is the Unified Pension Scheme (UPS) inflation indexation process?

UPS Inflation indexation ensures the fact of the increase in certain benefits depending upon the increase in living expenses. This is how it works:

- Basis for Indexation: The AICPI-IW is used to make adjustments with pension benefits as well as to understand the level of inflation faced by industrial workers all over India.

- Biannual Modifications: Seasonally, adjustment to pension amount is made twice a year that is the first of January and the first of July in accordance to AICPI-IW fluctuations.

- Dearness Relief: The adjustment affects the guaranteed pension, the family pension and the minimum pension.

- Example of Calculation: Namely, as of the second quarter, the inflation rate is experienced biannually at 2% and an initial pension of ₹40,000 per month the first adjustment would increase the pension by ₹800for the new monthly income of ₹40800.

Hence, through the process of making pensions easier to purchase other goods with increasing prices hence eradicating inflation, this procedure safeguards retired individuals.

Unified Pension Scheme (UPS)’s qualifying requirements?

The following are the requirements for eligibility to the Unified Pension Scheme (UPS):

- Lowest Possible Service Level: According to it, employees must be in serviceat least for ten years to avail benefits from the pension.

- Complete Benefits: All the benefits could only be provided to the workers who had served for not less than 25 years.

- Pension Based on Years of Service: The pension will directly be proportional to the number of years served in case the person has served for more than ten years but less than twenty-five years.

- For NPS Members Only: Employees may wish to opt for the UPS when they are already under the NPS or when employees decide to avail the VRS.

- Family Pension: In case the employee dies, 60% of the employee’s pension would be paid to the employee’s family/dependent.

OPS, NPS, and UPS

Old Pension Scheme (OPS)

- Guaranteed Pension: OPS provided a fixed pension amounting to 50% of the last drawn salary.

- Dearness Allowance (DA): Pension amounts were adjusted based on DA to account for inflation.

- No Employee Contribution: Employees did not contribute to their pension during their service.

- General Provident Fund (GPF): Employees contributed to GPF, which was returned with interest upon retirement.

New Pension Scheme (NPS)

- Market-Linked: NPS is a contributory scheme where the pension amount depends on the accumulated corpus and market performance.

- Employee Contribution: Employees contribute 10% of their salary, matched by a government contribution of 14%.

- No Guaranteed Pension: The final pension amount is not guaranteed and varies based on market returns.

- Flexibility: Offers potentially higher returns but with associated risks.

Unified Pension Scheme (UPS)

- Guaranteed Pension: UPS guarantees a pension amounting to 50% of the average basic pay over the last 12 months.

- Minimum Pension: Ensures a minimum pension of ₹10,000 per month.

- Inflation indexation: Pensions are adjusted for inflation based on the All India Consumer Price Index for Industrial Workers (AICPI-IW).

- Employee Contribution: Similar to NPS, employees contribute 10% of their salary, but the government's contribution increases to 18.5%.

- Lump Sum Payment: Provides a lump sum payment at retirement, calculated as 1/10th of monthly emoluments for every completed six months of service.

Lump sum facility

On this front the lump sum pay-out provision of the UPS contain a yield of extra funds to the employee once they have retired. The following are the essential particulars:

- Computation: At the end of service period, employees will be paid money equal to one tenth of their emoluments per month wages (pay structure consists of basic pay plus Dearness Allowance) for service rendered on half year basis.

- In addition to the gratuity: This lump sum pay-out is on top of the gratuity benefits that the employees are entitled to.

- No Impact on Pension:the lump sum amount doesn’t impact the pension amount of the employee, employee gets the pension amount as decided by the pension scheme.

Example: A payment structure for an organisation’s employees can be summarised as follows: An employee earning ₹80,000per month and has served for 30 years will receive lump sum payment of 1/10 of their salary for the served number of years.

They ensure at least at retirement age the employee has reasonable amounts of money on hand, offering employees the flexibility.

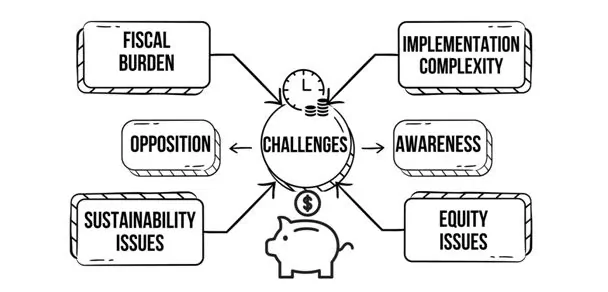

Major Challenges

Even though the Unified Pension Scheme (UPS) in India offers a lot of benefits, there are a few major obstacles to overcome:

- Fiscal Burden: Based on the period where the size of government workforce considerably increased and the increase of government contribution from 14% to 18.5%, the burden may shift to public treasury.

- Implementation Complexity: There will definitely be many changes in terms of administrative reforms when migrating from NPS to UPS which will result into more delays and confusion.

- Sustainability Issues: One of the biggest challenges is the ability to guarantee that the scheme will be sustainable in the long run especially with aspects such as guaranteed pensions and inflation indexation. There is reasonable doubt that it will be possible to sustain these benefits for another thirty years or so.

- Equity Issues: Trying to meet the all employees’ expectations under several schemes such as NPS, UPS, and OPS may lead to perceived injustice and this may not be good for the employees.

- Awareness and Training: While the implementation of change is challenging, it is even more so to train the administrative personnel to manage such change while at the same time, informing existing employee about the new benefits.

- Political and Public Opposition: Some people who may resist change to pension plans include the following: the employee unions are one of the most diametric groups that one may come across when it comes to matters concerning pension plans.

Present scheme by central government of India regarding financial protection of the employees after retirement.

Initiatives of the Government for Security of Employs after retirement:

The Indian government has launched several initiatives to enhance financial security for employees post-retirement:

- Unified Pension Scheme (UPS):The UPS which still awaits implementation as planned on 01.04.2025 aims at providing a genuine pension to the Indian government employees. For instance, the pension plans to be given to the employees who would have served for 25 years. Pensions for those that retire with shorter service years will be lesser and should not be less than ten years of service.

- National Pension System (NPS): An occupational scheme through which employees are expected to pay 10% of their wages whilst the government provides an additional 14%. It comes with market related rates of returns and could also allow for the diversification of investment.

- Atal Pension Yojana (APY):this is primarily aimed to unorganized workers and employees that offers guaranteed minimum pension between Rs 1000/- to Rs 5000/- per month based on the contribution slab.

- Pradhan Mantri Vaya Vandana Yojana (PMVVY): For this scheme, investors are assured an annual return of 7.4% percent to be collected on monthly basis for the individuals above the age of 60 years.

- Employees’ Provident Fund (EPF): A pre-funded social security plan in which the employee pays 12% of his or her wages to the scheme while the employer also contributes 12% of the wage. This amount can be availed by the employee at the time of retirement.

Its purpose is the development of the effective safety net for the employees as for their financial security during the retirement period.