NPS Vatsalya Scheme: It is a child pension plan which was started in India by a government. It is aimed at giving the parents and guardians the way to invest on behalf of their children for the future monetary needs. Perhaps, consider it in terms of a protection that guarantees our kids most importantly a financially secure future as they grow up.

Key Features

- Early Start, Long-Term Benefit: The scheme also satisfies the parents’ desire of starting early by opening a pension account for children. In this way, they use the ability to compound over a long period of time by investing in such operations.

- Flexible Contributions: It will be open to families who will be attending from all brackets of the economy. The initial investment can be made of Rs. 1,000 per year with child’s name and hence is quite affordable.

- PFRDA Oversight: PFRDA – Pension Fund Regulatory and Development Authority – is responsible for the management of the NPS Vatsalya Scheme.

How Does It Work?

- Opening an Account: Any parent or Legal guardian can open the NPS account for his/her child.

- Contributions: contributions can be made monthly or annually and until the age of 18 years is attained for a child.

- Wealth Accumulation: They continue to build up the corpus gradually which goes into building up a pension of child’s future.

- Tax Benefits: The scheme is beneficial under section 80C and section 10(14) of income tax Act in terms of tax exemptions.

Why Is It Important?

- Financial Security: NPS Vatsalya helps children to have some kind of saving where they can be assisted in case of any other emergencies.

- Retirement Planning: Especially to the retirement period where time is a real concern, beginning early will provide adequate time for wealth creation.

- Inclusive Approach: The requirement of a minimum investment is low and this will enable families in all categories to invest in the business.

How to Get Started

- Visit the NPS Vatsalya Portal: Subscriptions are done through an online platform on the parents’ own volition.

- PRAN Card: At the time of registration the child is issued with a PRAN card, the full form of which is ‘Permanent Retirement Account Number’.

Remember that, preparing for our children’s future is nothing but preparing for the Better future.

Eligibility for investing in NPS Vatsalya

The NPS Vatsalya Scheme is a thoughtful initiative for the future of children funds and therefore it is important to know the eligibility criteria of this scheme.

Eligibility Criteria

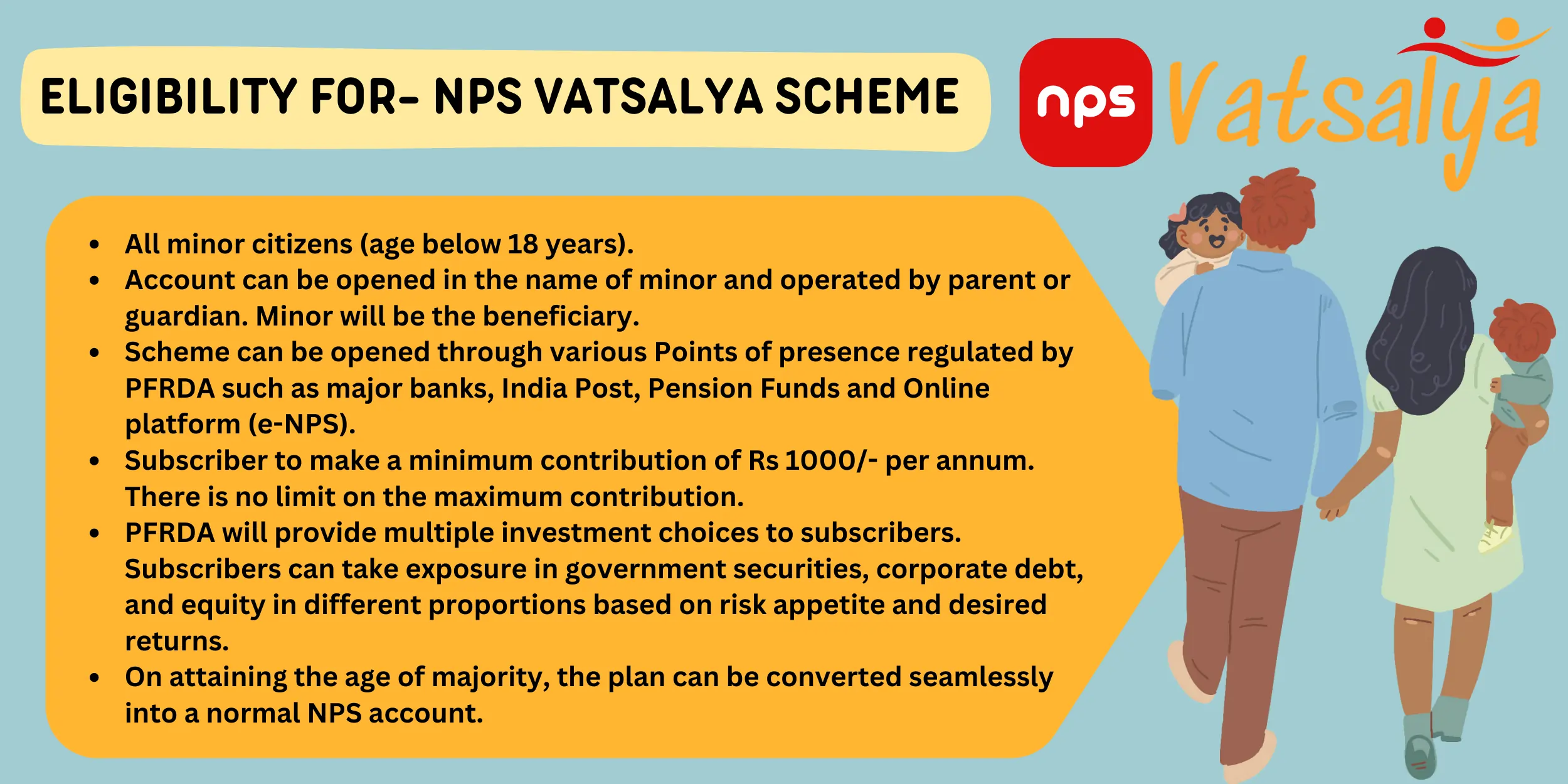

- Age Requirement: As for the program of the NPS Vatsalya Scheme, you need to know that your child should be less than 18 years of age. Therefore, it is tailored for the minors and has to follow the rules and requirement set for that cadre.

- Indian Citizenship: The child’s parent or legal guardian has to be an Indian citizen, and the same should be applicable with the child.

- Valid PAN Card: Your child should have a genuine PAN (Permanent Account Number) card with him/her.

- KYC Compliance: In this context parents, guardians and even the child, as the new account holders, must be KYC compliant.

Contribution Details: Minimum Annual Contribution: Even the parent or legal guardian, the contribution can begin from as low as Rs. 1,000 per annum for a child’s education. Due to having a very low minimum investment, it is possible for families of all economic status to invest.

Withdrawal Rules

- Lock-In Period: It is, however, locked in for a certain period with the possibility of withdrawals being made after a lock-in period of three years.

- Withdrawal Purpose: This is easily accessible where you can be able to access up to 25% of the accumulated corpus for specific reasons like education, illness or disability. This is applicable provided that it can only be performed a maximum of three times.

- Change at 18: NPS Vatsalya account gets converted to NPS Tier-I account under the ‘All Citizen’ category when your child attains 18 year of age. In the event that every single total savings commonly known as the corpus is over Rs. 2. 5 lakh, 80% has to be invested in an annuity product and 20% can be withdrawn in the form of lump sum. If the corpus is Rs. 2.5 lakh or less, the entire amount can be withdrawn as a lump sum i.e., 100% of the corpus can be withdrawn.

- In Case of Minor’s Death: It will be subjected to the law of the following: In the most unfortunate occurrence that the minor dies then the whole corpus shall be given back to the guardian.

Tax Benefits Associated with NPS Vatsalya

Tax Deduction for Contributions

Parents or a guardian who contributes towards the NPS Vatsalya account for their minor dependent children can opt for tax exemptions. The parent can avail benefits under Section 80C (1) of the Income Tax Act.This is usually calculated as not more than ten percent of the parent’s income which is earned through his/her basic salary plus dearness allowance. However, if the contribution is done by the Central Government that is for the government employees then the allowed deduction limit is 14% of the salary.

Tax-Free Accumulation

Donations received for the NPS Vatsalya account are allowed to accumulate tax-free during the years. This is to mean that the interest accrued and capital gains made are not subjected to income tax during the build-up phase.But remember that at the time of withdrawal (that is after the child turns 18), there could be some of all implications depending on the selected annuity option or lump sum withdrawal of the money.

Wealth Accumulation for Retirement

The NPS Vatsalya Scheme is a deferred as well as accumulated pension planning regime where Individuals can effectively save for their retirement. If parents begin making these contributions from an early age and continue the process diligently, they will be surprised by the large sum that they will accumulate for the child’s benefit in future.The amount that has been saved can come in handy as an after they grow old the child may require to retire and may be have no source of an income.

What are the Challenges associated with it

That being said, the NPS Vatsalya Scheme is a good start but like any financial product that is there in the market, it does come with its share of flaws.

Restrictive Withdrawal Rules

A major downside of the NPS Vatsalya scheme is its withdrawal guideline through which restricts one’s withdrawal capacity. It becomes disadvantageous for the parents if they have to withdraw the funds early for example, for education purposes or some other crucial expenses. There is the lock-in period for the scheme and withdrawal provisions of the scheme shall be in accordance with the set measures. In other words, while it promotes the savings for future use it may not be as convenient in case of an urgent need.

Market-Linked Returns

As such, the NPS Vatsalya scheme is described to offer market-related returns and as such, the final corpus depends with the market. On one hand this is useful during a bull market to which the investment is exposed on the other hand hence the volatility. It is of paramount important for parents to know this risk is present, and cannot expect to achieve greatness for their child immediately.

Changing Financial Goals

In terms of financial goals they are malleable over an 18-year investment cycle. It is hard to say today what is required to be included and what is not necessary while designing the product of the future. It would be wise for parents to consult and have a check on their child and then they can change their investment plan now and then.

Lack of Awareness

However, even with deliberate intent to make the populace financially literate through government or non-governmental organizations and other establishments, many parents and guardians still have no idea about such schemes. This lack of awareness reduces participation levels and thus the families fail to get the benefits of NPS Vatsalya.

Way Forward:

Exploration of challenges fostered by the NPS Vatsalya Scheme requires understanding and analysis in order to come up with appropriate measures in tackling the challenges.Let’s explore some ways to address these hurdles:

Plan for Liquidity Needs

However, the scheme has an attachment period to the investments plan, and therefore, an individual has to factor his/ her liquidity requirements. Perhaps managing an emergency cash folder or any other investment that may give more freedom should be kept into consideration. Meanwhile, this also benefits you in that you don’t have to heavily rely on the NPS Vatsalya corpus in case of immediate needs.

Diversify Investments

Do not go for one thing at a time, to avoid losing it all. Apart from investing in NPS Vatsalya, look for the other investment opportunities. It reduces avoidable risks and guarantees that your child’s financial plan is not hinged on the scheme alone.

Understand the Withdrawal Rules

What rules the scheme has sets out on withdrawals also need to be known. It is however allowed to start partial withdrawals after three years but plan well. Employ such withdrawals wisely in a manner such as; education expenses, medical bills or any other emergent necessity.

Regularly Review and Adjust

Life circumstances change. Regularly monitor the specific objectives of your child and then align a plan of investment on the goals. If such is the case, it is advised to consult an expert in the finance field to avail with the said change.

Educate Your Child

When your child starts growing up, include him or her in family budgeting. Bring them to understand the right use of the money, how to save and the significance of long-term planning. Thus the NPS Vatsalya account tends to become a good teaching example.

Explore Different Asset Classes

NPS Vatsalya mainly focuses in the debt and equity securities. You could further diversify by trying out other forms of investments such as mutual funds, fixed deposits or gold. Both have their risks and rewards option attached to it.

Stay Informed

It is also important to get informed about any new developments or improvements done to the NPS Vatsalya Scheme. Government policies do change, thus one needs to come up-to-date in order to make wise decisions.